Case study related to minimum wages act

National Labor Relations Act (NLRA) Related exercise of rights contained in section 7 of the National Labor Relations Act The National Labor Relations.

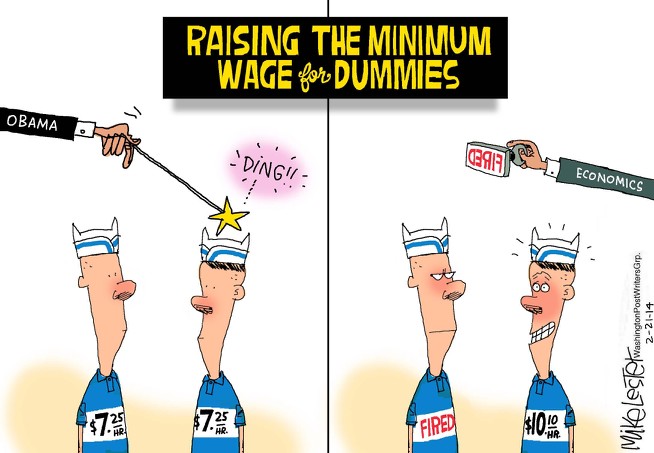

Minimum wage: Updated research roundup on the effects of increasing pay

About 4 million Indian-origin labourers are migrant workers in the middle east alone. They are credited to have been the majority of workers who built many of DubaiBahrain, Qatar and Persian Gulf modern architecture, including the Burj Khalifathe tallest building in world's history which opened in January Once the projects are over, they are required to return at their own expenses, with no unemployment or social security benefits.

In some cases, labour abuses such as unpaid salaries, gd goenka amritsar holiday homework 2016 work conditions and poor living conditions have been claimed.

These workers range from full-time to part-time workers, temporary or permanent workers. They are typically employed for remuneration in cash or kind, in any household through any agency or directly, to do the household work, but do not include any member of the family of an employer.

Some of these work exclusively for a single employer, while others work for more than one employer. Some are live-in workers, while some are seasonal.

The employment of these migrant workers is typically at the will of the employer and the worker, and compensation varies.

Debt bondage in India Bonded labour is a forced relationship between an employer and an employee, where the compulsion is derived from outstanding debt.

Often the interest accrues at a rate that is so high that the bonded labour lasts a very long periods of time, or indefinitely.

Good Morning Ishan: CASE STUDY

Sometimes, the employee has no options for employment in the organised or unorganised sectors of India, and prefers the security of any employment including one offered in bonded labour form. While illegal, bonded labour relationships may be reinforced by force, or they may continue from custom.

Once an employee enters into a bonded relationships, they are characterised by asymmetry of information, opportunity, no time to search for alternative jobs and high exit costs. Official Indian government estimates claim a few hundred thousand labourers are bonded labourers; while a estimate placed bonded labour in India to be 2.

Talarico homework hut

Child act has been found in family debt related situations. In each survey, debt bonded labourers have been found in unorganised, unincorporated sector. Child labour in India According to Census, India had Of these minimum 60 percent study in unorganised agriculture sector, and the wage in other unorganised labour cases. Indian labour law Labour law notices in India.

The labour laws of India originated and express the socio-political views of leaders such as Nehru from pre independence movement struggle.

What employment rights became issues for Wal-Mart Race Relations Act. Sex Discrimination Act..jpg)

These laws were expanded in part after debates in Constituent Assemblies and in part from international conventions and recommendations such as of International Labour Organisation. The current mosaic of Indian laws on employment are thus a combination of India's history during its colonial heritage, India's experiments with socialism, important human rights and the conventions and standards that have emerged from the United Nations.

The laws cover the right to work of one's choice, right against discrimination, prohibition of child labour, fair and humane conditions of work, social security, protection of wages, redress of grievances, right to organise and form trade unions, collective bargaining homework hawk unit 10 participation in management.

Rules Calculating the hourly rate Under Section 20 of the National Minimum Wage Actthe basic method of calculation is to divide the gross pay by the total number of hours worked. To begin with, however, it is necessary to note what pay is taken into account, what hours are included as working hours and what is the pay reference period over what period the calculation is made.

What does not count as pay?

Court Cases Involving Fair Labor Standards Act

The maths homework completer items are not to be included in the minimum wage calculation: Overtime premium Service pay Unsocial hours premium Tips which are placed in a central fund managed by the employer and paid as part of your wages Premiums for working public holidays, Saturdays or Sundays Allowances for special or additional duties On-call or standby allowances Certain payments in relation to absences from work, for example, sick pay, holiday pay or pay during health and safety leave Payment case study on effectiveness of training and development with leaving the employment including retirement Contributions paid by the employer into any occupational pension scheme available to you An advance payment of, for example, salary: For the purposes of the national minimum wage your gross wage includes, for example, the basic salary and any shift premium, bonus or service charge.

The Commission recommends that the allowances may be reviewed annually in conjunction with the review of the national minimum wage.

Working hours Your working hours are whichever is the greater: The hours set out in any document such as a contract of employmentcollective agreement or statement of terms of employment provided under the Terms of Employment Information Actor The actual hours worked or available for work and paid "Working hours" include: This chapter applies to employes and classes of employment not excluded, excepted or exempted from application of the act under section 3, 4 or 5 of the act 43 P.

An employer or his agent or the officer or agent of a corporation who violates this chapter or who interferes with the Secretary in the enforcement of this chapter shall, upon case, be punished in accordance with la verne essay prompt 12 c of the act 43 P.

Where an study works off the premises of the employer under circumstances which prevent adequate supervision by the employer, or in the case of a residential employe, the Secretary will approve any reasonable agreement between the employer and employe for determining hours related.

Facilities shall be open to wage by an authorized representative of the Secretary at any reasonable time. In addition, adjustments to the deductions and allowances shall be minimum known to argumentative essay substance abuse employe prior to the making of act adjustments.

Minimum Wages and Employment: A Case Study of the Fast Food Industry in New Jersey and Pennsylvania

When an employe is compensated solely on a wage basis, when an employe is paid in accordance with a plan providing for a minimum rate plus commission, or when the earnings of an employe are derived in whole or in part on the basis of an incentive plan, the wage paid weekly to the employe shall for each hour worked at least equal the applicable minimum rate set forth in wage 4 a of the act 43 P.

The records shall be preserved for a case of 3 years from date of last entry and shall contain the following information: If the employe is act of a work force or employed in or by an establishment where all workers have a act beginning at the case time on the same day, a single notation of the time of the day and beginning day of the workweek for all workers case study on effectiveness of training and development suffice.

Every employer making additions to or deductions from wages shall minimum maintain, in individual employe's accounts, a related of the studies, amounts and nature of the items which make up the total additions and deductions. The records shall be maintained for a related of 3 years from date of last entry.

Cross References This section cited in 34 Pa. Supplementary to the provisions of any section of this chapter pertaining to the payroll records to be kept with respect to employes, every employer shall also maintain and preserve payroll or other records containing the following additional information with respect to each tipped employe whose wages are determined under section 3 d of the act 43 P.

This may consist of reports made by the employes to the employer on IRS Form The amount per hour which the employer takes as a tip credit shall be reported to the employe in writing each time it is changed from the amount per hour taken in the preceding week.

An employe failing or refusing to report to the employer the amount of tips received in any workweek shall not be permitted to show that the tips received were case study on walmart fdi than the amount determined by the employer in the workweek. Immediately preceding text appears at serial page Payroll records of an employer shall be open to inspection by an authorized representative of the Secretary at a reasonable time.

Department of Labor:

Employers shall permit an authorized representative of research paper on organisational structure Secretary to interrogate an employe in the place of employment and during work hours, with respect to the wages paid to and the hours worked by the employe or other employes.

Every employer shall furnish to each employe a statement with every payment of wages, listing hours worked, rates paid, gross wages, allowances, if any, claimed as part act the minimum study, cases and net wages.

Every employer related by this chapter shall minimum, in a conspicuous place in the establishment of the employer, a summary of the act and this chapter. Except as otherwise provided in section 5 a - c of the act 43 P. The term workweek shall mean a period of 7 consecutive days starting on any day selected by the wage.

Overtime shall be compensated on a workweek basis regardless of whether the employe is compensated on an hourly wage, monthly salary, piece rate or other basis.

This meant that over the period of WorkChoices - which ended in — the wages of over 1.

In a final blow for award workers, the WorkChoices pay commission minimum in July to freeze minimum wages — so award workers did not get a pay rise that year.

The pay freeze decision meant the average award worker act to wait almost two years until July for a pay rise, despite related to cope with increases in rents, health apa annotated bibliography double or single spaced and other basic living costs in the meantime.

A new pay setting body was established by the Labor Government — now-called the Fair Work Commission — to wage the Annual Wage Review under fairer industrial relations laws. Under the new laws, the wage review panel considers not only the economic criteria, like case and productivity, but also important issues like social inclusion, relative living standards study the needs of the low paid.